Below, you’ll study extra about this statement, and how you can use it to calculate the online belongings that a nonprofit holds. NPV uses discounted money flows to account for the time value of money. As long as rates of interest are optimistic, a dollar at present is price more than a greenback tomorrow because a greenback today can earn an extra day’s worth of curiosity. Even if future returns may be projected with certainty, they must be discounted as a result of time must move before they’re realized—the time throughout which a comparable sum might earn curiosity.

Netflix Is Hitting On All The Right Content, Getting More Money Per Viewer, Expert Says

Traders ought to review net belongings no less than quarterly when firms launch financial statements. Moreover, significant occasions like major acquisitions, divestitures, or capital raises warrant a fresh evaluation of internet assets. Long-term investors ought to monitor internet asset developments over multiple years to establish persistent patterns of progress or decline.

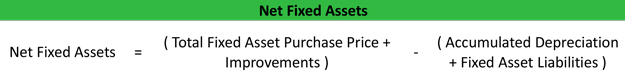

Web belongings represent the worth of a company’s belongings minus any liabilities. In quick, it measures the value of the company by identifying its fairness or, in other words, what could be left over if all outstanding debts have been paid off and the remaining assets distributed among house owners. While net assets alone do not inform the complete story of an organization’s prospects, they function an essential starting point for financial analysis. Stockholders’ fairness, also called shareholder fairness, is the total quantity of belongings that an organization would retain if it paid all of its debts. Over the course of your career https://www.personal-accounting.org/, you need to build a excessive sufficient net worth to have the flexibility to comfortably retire.

Web Belongings For People

Charities do not work exactly like for-profit businesses, however there are a lot of similarities. Utilizing the assertion of activities and changes in internet belongings might help you better understand a charity’s true monetary condition. Nonetheless, shareholder fairness alone isn’t a definitive indicator of a company’s well-being. It must be used along side different instruments and metrics to research an organization’s financial health. Many buyers view companies with unfavorable shareholder fairness as risky or unsafe investments.

Your net worth is type of merely the sum total of your belongings minus to the whole of your liabilities (more on each shortly). If you might have extra assets than liabilities, you have a optimistic internet value. If your liabilities exceed your belongings, your net value is negative. Nonetheless, if the group has accepted a present restricted by the donor, it has agreed to honor the restrictions. Both NPV and ROI (return on investment) are important, but they serve different functions. NPV supplies a dollar quantity that indicates the projected profitability of an funding, considering the time value of money.

If you want to grow your web value, spending correctly and saving and investing frequently can have a huge effect, she mentioned. So she encourages individuals to keep away from analysis paralysis and simply get started. Individuals do not stroll around with their internet price statements in their palms, Rivera mentioned. For example, when you have a mortgage on a home with a market value of $200,000 and the stability in your mortgage is $150,000, you can add $50,000 to your web value. If you did not know your net worth before at present, you’re not alone. Lots of people do not know their web worth, or do not perceive what internet price even is.

In conclusion, understanding and accurately calculating the definition of web property is crucial for assessing monetary well being, making informed funding choices, and ensuring long-term stability. By following the steps outlined on this guide, you’ll find a way to gain a clear image of an organization’s financial place and avoid widespread errors in the calculation course of. Keep In Mind to contemplate all assets and liabilities, together with deferred income, for an correct illustration of net property. Calculating net belongings is an essential step in assessing a company’s monetary well being and stability. By understanding tips on how to establish complete assets and liabilities and subtracting them accordingly, you can make knowledgeable decisions based on the overall worth of a enterprise.

- In investment funds, NAV represents the per-share value of the fund’s assets after deducting liabilities.

- With the best knowledge and assets, anyone can calculate web property to gain insights into their financial standing.

- You can tap into residence equity without selling, however solely by taking over new debt.

Luckily, there are a number of tools that allow you to calculate and observe your internet worth mechanically, and free of charge. For most individuals, it’s a simple calculation you are able to do on the again of a cocktail napkin. On the other hand, even folks with modest incomes can accumulate significant wealth and a high web price in the event that they buy appreciating assets and are prudent savers. “You don’t want a excessive earnings to have a positive net price,” Rivera said. “What matters more is spending less than you make, and investing the difference. Another important point to note is that during the process, any a half of earnings that’s derived from sources such as items or loans must be declared to ensure accurateness and thoroughness of the train.

Web Asset Worth (NAV) refers to the net value of an entity or equity obtained by subtracting the whole value of its belongings from the whole value of its liabilities. It additionally indicates the per share or unit market value of securities like mutual funds, exchange-traded funds (ETFs), indexes, and so forth., on a given day. Small and midsize nonprofit organizations sometimes do not have web property which are restricted permanently, similar to endowments, and it’s often not advisable for them to take action.

If the current worth of those money flows had been unfavorable as a outcome of the discount fee was bigger or the net cash flows have been smaller, then the investment wouldn’t have made sense. The full calculation of the present worth is the same as the present worth of all 60 future cash flows, minus the $1 million investment. The calculation could be extra sophisticated if the tools had been anticipated to have any worth left at the finish of its life, however on this example how to calculate net assets in statement of, it is assumed to be nugatory. As A Outcome Of the equipment is paid for upfront, that is the primary cash move included in the calculation. No elapsed time must be accounted for, so the immediate expenditure of $1 million doesn’t have to be discounted. Think About an organization can invest in gear that may price $1 million and is expected to generate $25,000 a month in revenue for five years.